UDIA Victoria’s The Hidden Cost of Housing research highlights how much of a new home purchase price is attributable to Commonwealth, State and Local Government taxes, charges and levies.

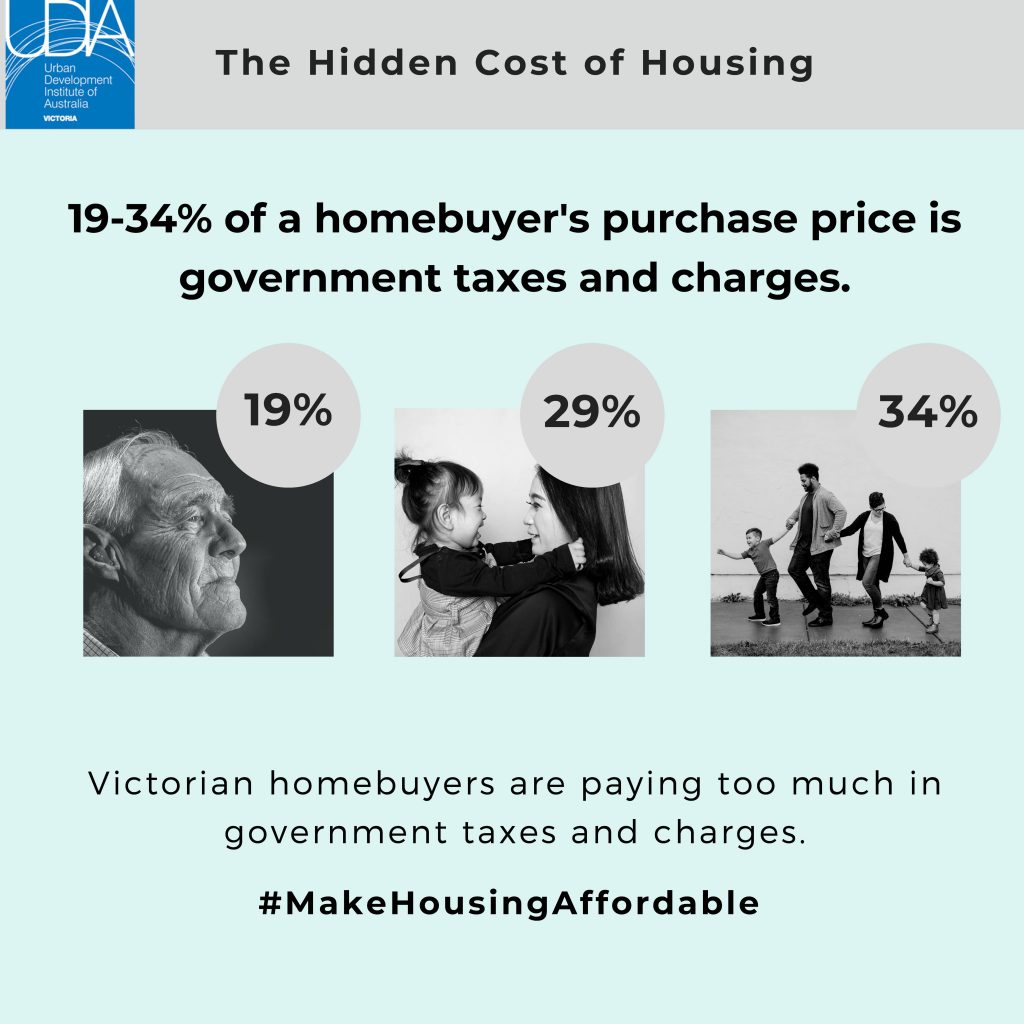

The research shows that government charges cost local homebuyers up to 34% of their purchase price.

In all examined cases, the cost of government charges is significantly higher than the developer’s profit – a finding that disproves the view that home prices are high because developer profit margins are high, and shows that the developer cannot absorb a greater amount of taxes and charges.

The research bolsters UDIA Victoria’s calls for tax reform, a moratorium on new taxes and charges, and a radical approach to cutting planning and development approval red tape.

Key findings

- The research shows that government charges cost up to 34% of a local homebuyer’s purchase price of a new residential lot or dwelling, depending on the circumstances of the homebuyer and the property they are buying.

- Taking interest costs into account, the research finds that the large up-front cost impost then sits in the homebuyer’s mortgage, adding significantly to the length and cost of their mortgage.

- In all examined cases, the total cost of government taxes, charges and levies on homebuyers is higher than the developer’s profit – a finding that disproves the view that home prices are high because developer profit margins are high.

- Foreign homebuyers pay up to 40% more in taxes and charges than domestic homebuyers in the examined scenarios. This is an issue particularly if the foreign buyer later sells to a domestic purchaser at a price that reflect the higher price they paid.

- The approach in this report has been deliberately conservative with several taxes and charges excluded. The cost to buyers and pressure on development feasibility is therefore expected to be much higher in many circumstances.

- In conclusion, government taxes and charges have a real impact on the cost of housing in Victoria.

We’re using this research to:

- Shine a light on how much Commonwealth, State and Local Government taxes, charges and levies contribute to the cost of new housing in Victoria.

- Demonstrate the need for a co-ordinated, whole-of-government approach to ensure taxes and charges do not accumulate to reach unsustainable levels for homebuyers.

- Humanise the impact of taxes and charges by showing them through the eyes of a range of buyer profiles representing a cross-section of Victoria’s homebuyers.

- Inform homebuyers about these costs so collectively we can hold government accountable on how taxes and charges are spent, and if they increase.

- Disprove the view that home prices are high because developer profit margins are high, and show that industry cannot absorb higher charges.

- Bolster UDIA Victoria’s calls for tax reform, a moratorium on new taxes and charges, and a radical approach to cutting planning and development approval red tape.

Media release: Government taxes and charges equal one-third of new homebuyer costs

19-34 per cent of a Victorian homebuyer’s purchase price goes to government taxes and charges, reveals new research by the Victorian Division of the Urban Development Institute of Australia (UDIA Victoria).

Released today, The Hidden Cost of Housing research shines a light on how much Commonwealth, State and Local Government taxes, charges and levies contribute to the cost of new housing in Victoria.

“We’ve found that government charges can amount to over a whopping one-third of the purchase price of a new home or block of land in Victoria,” said CEO of UDIA Victoria, Danni Hunter.

“The large up-front cost then sits in the homebuyer’s mortgage, accumulating interest which adds even more to the amount they pay,” she said.

The Hidden Cost of Housing research humanises the impact of taxes and charges by showing them through the eyes of a range of buyer profiles representing a cross-section of Victoria’s homebuyers.

Tom and Emily are schoolteachers with two kids, buying a block of land in Melbourne’s growth areas for $315,000. Of that price, over $106,000 is government taxes and charges, equating to 34 per cent of Tom and Emily’s purchase price.

“Homebuyers make an important contribution to city-building, vital infrastructure and amenities through government taxes and charges. But there is a cost to the high rate of government taxes and charges, and it’s important that homebuyers are informed about these costs and that government is held accountable for how they are spent and if they increase,” said Ms Hunter.

“The cost of government charges is significantly higher than the developer’s profit – a finding that disproves the view that home prices are high because developer profit margins are high, and shows that the developer cannot absorb all those taxes and charges either,” she said.

“We need targeted tax adjustments. Lower taxes would increase the volume of new home sales, which would ultimately achieve the same tax revenue for government, while making housing more affordable for Victorians.”

The research bolsters UDIA Victoria’s calls for tax reform, a moratorium on new taxes and charges, and a radical approach to cutting planning and development approval red tape.

“We must get real about the high cost of housing in this state. Every Victorian deserves suitable housing, which is affordable relative to their income. It is incumbent on the government to make housing affordable,” said Ms Hunter.

– ENDS –